The proposal to issue $2K tariff checks to U.S. households has drawn national attention, but the plan remains unapproved and unscheduled, according to public statements from administration officials. While proponents say tariff revenues could fund direct payments, Congress has not authorized such a program, leaving its timing, eligibility, legal basis, and economic impact uncertain.

Table of Contents

$2K tariff checks

| Key Issue | Current Status | Why It Matters |

|---|---|---|

| $2K tariff checks | Proposal only | No law exists to authorize payments |

| Funding source | Tariff revenue | Raises questions about sufficiency and stability |

| Congressional role | Required | Constitution grants Congress spending authority |

| Eligibility rules | Undecided | Could significantly change total cost |

| Payment timeline | None | No bill, vote, or implementation schedule |

| Economic impact | Debated | Risks include inflation and budget tradeoffs |

What Are the $2K Tariff Checks?

The $2K tariff checks refer to a proposed one-time cash payment of roughly $2,000 per recipient, potentially funded by revenue collected from U.S. import tariffs. The idea has been framed as a way to return tariff proceeds directly to Americans rather than allocating the funds solely toward deficit reduction or existing federal programs.

Tariffs are taxes placed on imported goods and are typically paid by importers, who may pass some or all of the cost on to consumers through higher prices. Because tariffs can raise consumer costs, supporters of the proposal argue that a rebate could help offset those effects, particularly for households facing higher prices on everyday goods.

Opponents counter that tariff revenue is not a separate or “free” pool of money, noting that it ultimately comes from economic activity tied to consumer demand. From that perspective, returning tariff revenue as cash payments may reduce fiscal flexibility while doing little to address underlying price pressures.

The proposal does not currently exist as a formal bill. Instead, it remains a policy concept discussed publicly by political leaders and advisers, without statutory language defining how it would work in practice.

No Law, No Checks

Despite heightened public interest, no legislation currently authorizes the $2K tariff checks. Under the U.S. Constitution, Congress holds the power of the purse, meaning that federal funds cannot be spent without congressional approval.

This legal framework is central to understanding why repeated public discussion has not translated into actual payments. Even if tariff revenue is available, the executive branch cannot unilaterally distribute funds to individuals.

For the checks to become reality, lawmakers would need to pass a bill specifying:

- Who qualifies for the payments

- Whether the checks are taxable

- How many payments would be issued

- Which federal agency would administer them

- Whether tariff revenue is permanently or temporarily earmarked

Without such legislation, the Treasury Department lacks authority to act. Past federal payment programs, including stimulus checks, followed this same legislative process.

Funding Questions and Economic Debate

One of the most significant unanswered questions surrounding the $2K tariff checks is whether tariff revenue could realistically support a program of this scale.

While tariffs can generate substantial revenue annually, the total amount fluctuates based on trade volumes, enforcement, exemptions, and economic conditions. A nationwide payment of $2,000 per recipient could cost hundreds of billions of dollars, depending on eligibility criteria.

Some economists argue that dedicating tariff revenue to rebates could reduce funds available for deficit reduction or other federal priorities, including infrastructure, defense, or entitlement programs. Others warn that treating tariff revenue as a funding stream for cash payments may create long-term budget pressures if trade volumes decline.

Inflation is another concern. Large direct payments can increase consumer spending, which may contribute to price pressures if the economy is already operating near capacity. Supporters respond that a one-time, targeted payment would limit this risk compared with recurring or universal programs.

The debate reflects broader disagreements over fiscal policy, government intervention, and the role of trade policy in domestic economic support.

Eligibility Remains Undefined

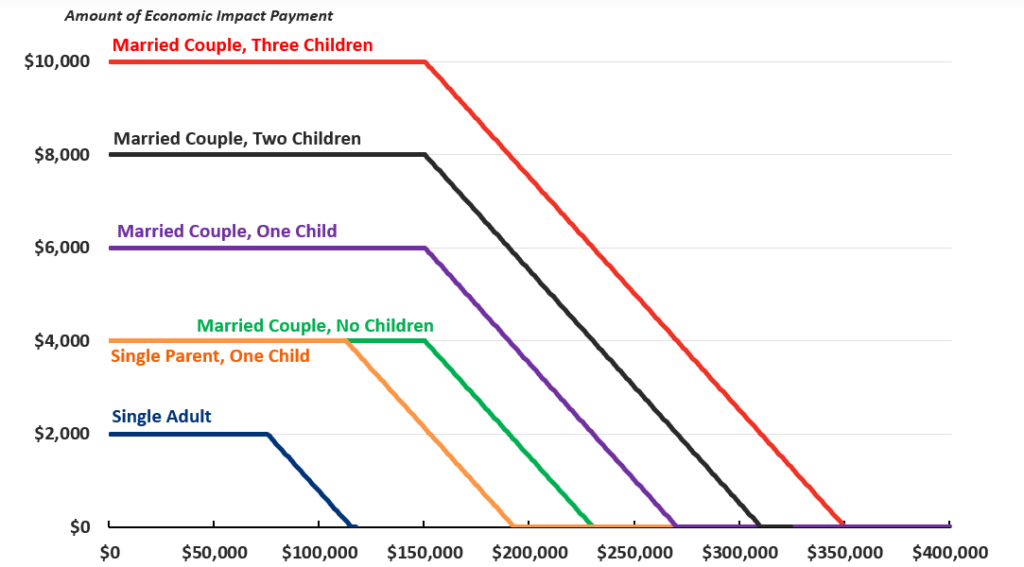

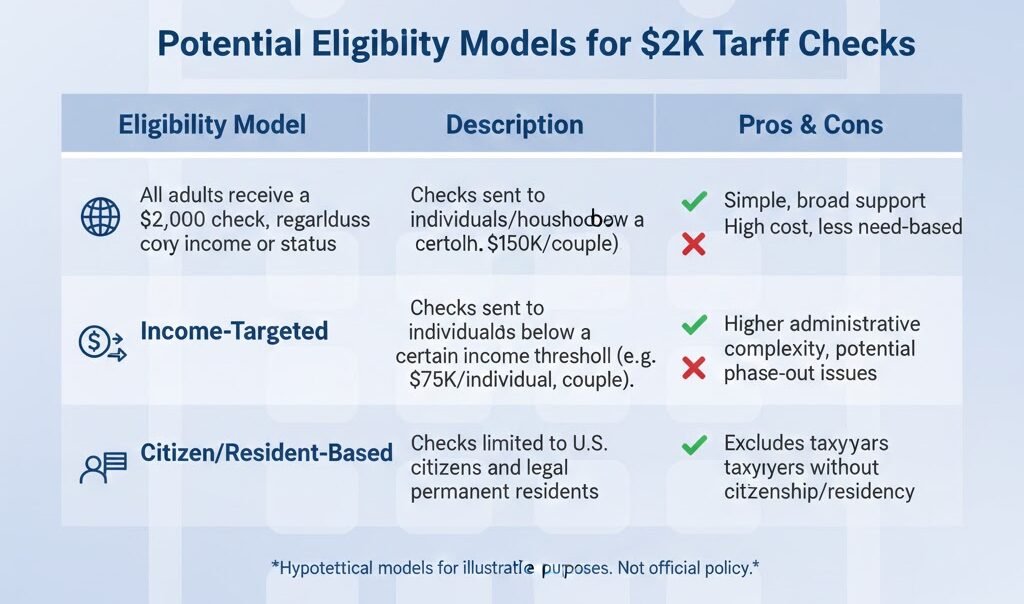

No official eligibility rules for the $2K tariff checks have been released. Public discussions have suggested several possible frameworks, but none have been adopted or formally proposed.

Potential eligibility models include:

- Income-based thresholds

- Payments limited to tax filers

- Household-based rather than individual payments

- Exclusions for higher-income earners

Each approach carries different budgetary and political implications. Broader eligibility increases total cost but simplifies administration, while narrower targeting reduces cost but can slow implementation and create disputes over fairness.

Past payment programs show that eligibility design is often among the most contentious parts of legislative negotiation, sometimes delaying final passage or complicating rollout.

How This Differs From Past Stimulus Payments

Unlike pandemic-era stimulus checks, the $2K tariff checks are not tied to an economic emergency or automatic stabilizer built into the tax system. Instead, they represent a discretionary policy choice linked specifically to trade revenue.

Stimulus payments enacted during economic crises were designed to support demand during downturns and were often justified as emergency relief. By contrast, tariff checks would reflect a redistribution of trade-related revenue during normal economic conditions.

This distinction raises legal, economic, and political questions, particularly about whether tariff revenue should be earmarked for rebates rather than absorbed into the general budget. It also affects how lawmakers and the public perceive the urgency and necessity of such payments.

Legal Authority and Executive Limits

Beyond funding and economics, legal authority plays a central role in the debate. Courts have historically recognized broad executive authority over trade policy, but spending decisions remain firmly within Congress’s domain.

Even if tariffs are imposed under executive authority, redirecting the resulting revenue to individuals requires explicit legislative approval. This separation of powers limits the executive branch’s ability to act independently, regardless of political support or administrative readiness.

Legal experts note that bypassing Congress in this area would almost certainly face constitutional challenges, making legislative action not only necessary but unavoidable.

Political Outlook

The political landscape surrounding the $2K tariff checks remains unsettled. Some lawmakers view the proposal as a politically attractive way to demonstrate tangible benefits from trade policy. Others express concern about fiscal discipline and precedent.

Supporters argue that rebates could help maintain public support for tariffs by directly sharing revenue with households. Critics warn that such payments could normalize ad hoc cash transfers without clear economic justification.

At present, no vote has been scheduled, no bill has advanced through committee, and no bipartisan framework has emerged. Any progress would likely depend on broader negotiations over trade, taxes, or budget priorities.

Public Perception and Communication Challenges

Public interest in the $2K tariff checks highlights a recurring challenge in economic policy communication. Proposals discussed publicly can be mistaken for finalized programs, leading to confusion about timelines and expectations.

Officials have emphasized that discussion does not equal authorization, but mixed messaging can still fuel public anticipation. Clear communication about legislative requirements and procedural steps remains essential to managing expectations.

What Happens Next

For now, the $2K tariff checks remain a proposal rather than policy. Their future depends on whether lawmakers introduce legislation, how the program would be structured, and whether sufficient political consensus can be reached.

If a bill were introduced, it would still need to move through committee review, floor votes in both chambers, and presidential approval before any payments could be issued.

Until then, officials continue to stress that Americans should not expect checks without formal congressional action.

FAQ

Are $2K tariff checks approved?

No. There is currently no law authorizing them.

Is there a payment date?

No payment date has been announced.

Would everyone qualify?

Eligibility has not been defined and would depend on legislation.

Are tariff revenues guaranteed funding?

Tariff revenue exists, but using it for checks would require explicit congressional approval.

Could the proposal change?

Yes. If legislation is introduced, the amount, eligibility, and structure could differ significantly from early discussions.