Retirement age changes coming in 2026 will affect millions of Americans, completing a decades-long shift in Social Security rules that moves full retirement benefits beyond age 65. The change alters when workers can collect full payments, reshaping long-standing expectations about retirement timing, income security, and workforce participation.

Table of Contents

Retirement Age Changes Coming in 2026

| Key Fact | Detail |

|---|---|

| Full retirement age in 2026 | Reaches 67 for those born in 1960 or later |

| Earliest claiming age | 62, with permanent benefit reductions |

| Medicare eligibility | Remains at age 65 |

| Policy origin | Retirement age increase enacted in 1983 |

| Demographic driver | Longer life expectancy, fewer workers per retiree |

What Is Changing in 2026

The retirement age changes coming in 2026 finalize a gradual increase in the full retirement age, the point at which retirees qualify for 100 percent of their earned Social Security benefits.

Under federal law passed in 1983, the full retirement age has been rising incrementally based on birth year. For individuals born in 1960 or later, full retirement age reaches 67 beginning in 2026, according to the Social Security Administration.

This marks the final step of a schedule set more than four decades ago, designed to account for longer life expectancy and changing population dynamics. Earlier cohorts experienced smaller increases, moving first from age 65 to 66, then gradually higher.

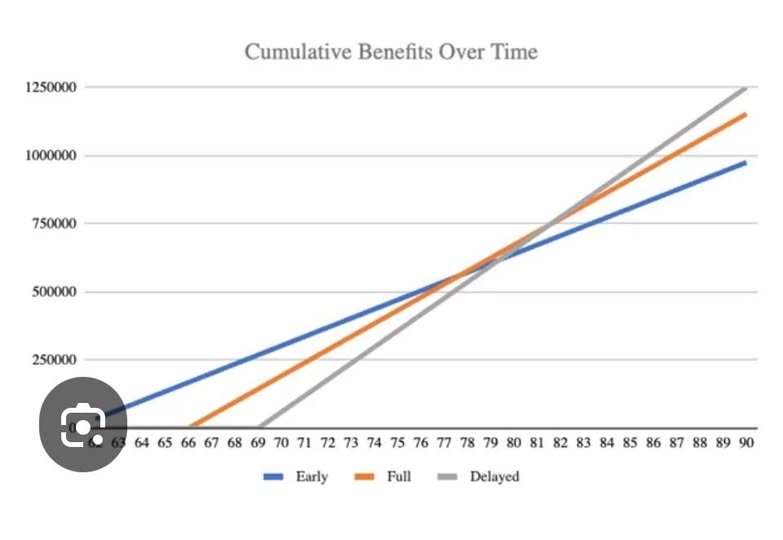

This does not eliminate the option to claim benefits earlier. Americans may still begin collecting Social Security as early as age 62. However, doing so permanently reduces monthly payments, with the size of the reduction depending on how early benefits are claimed.

According to the Social Security Administration, someone with a full retirement age of 67 who claims benefits at 62 receives about 70 percent of their scheduled monthly benefit. Claiming at 65 results in a smaller, but still permanent, reduction.

Why “Retire at 65” Became the Norm

The idea of retiring at 65 became widely accepted in the mid-20th century, when Social Security rules, employer pensions, and life expectancy aligned more closely.

When Social Security was established in 1935, average life expectancy at birth in the United States was about 61 years, according to data from the Centers for Disease Control and Prevention. Retirement was often brief, and many workers never collected benefits at all.

By the time Medicare was introduced in 1965, age 65 had become a fixed milestone for both retirement income and health coverage. Employers structured pensions around that age, reinforcing its cultural importance.

Today, Americans live significantly longer. Average life expectancy now exceeds 76 years, while life expectancy at age 65 extends well into the mid-80s. That longevity increases the number of years retirees draw benefits and magnifies the financial demands placed on Social Security.

Despite these changes, the cultural expectation of retiring at 65 persisted long after the underlying economics shifted.

The Financial Pressures Behind the Shift

The retirement age changes coming in 2026 reflect long-term financial pressures facing Social Security, rather than a sudden policy decision.

According to the Social Security Trustees’ annual report, the program is projected to pay more in benefits than it collects in payroll taxes for the foreseeable future. Without policy changes, trust fund reserves are expected to be depleted in the mid-2030s, after which incoming revenue would cover only a portion of scheduled benefits.

One major driver is demographics. As the baby boom generation retires, the ratio of workers paying into the system compared with retirees receiving benefits has declined sharply. In the 1960s, there were more than five workers per beneficiary. Today, there are fewer than three.

Raising the full retirement age effectively reduces lifetime benefits by encouraging longer work lives or smaller monthly payments. Policymakers have historically viewed this approach as less politically disruptive than direct benefit cuts.

“The increase in the full retirement age was designed to reflect longer life spans and help stabilize the program,” said a senior analyst cited in previous Associated Press reporting on Social Security reforms.

What Is Not Changing

Despite the retirement age changes coming in 2026, several key elements remain unchanged.

Medicare eligibility still begins at age 65, regardless of Social Security retirement age. Workers can enroll in Medicare even if they delay Social Security benefits until 67 or later, a distinction that often causes confusion.

The earliest eligibility age for Social Security, 62, also remains the same. However, benefits claimed early are reduced for life, a trade-off that becomes more significant as full retirement age rises.

Annual cost-of-living adjustments, tied to inflation, continue to apply to benefits already in payment status. These adjustments protect purchasing power but do not offset reductions caused by early claiming.

Survivor and disability benefits are also unaffected by the change in full retirement age, operating under separate eligibility rules.

How Workers May Respond

Economists say the retirement age changes coming in 2026 are likely to influence both retirement planning and labor force participation.

Some workers may choose to stay employed longer to avoid reduced benefits, particularly those without employer pensions or substantial savings. Others may retire earlier but rely more heavily on personal retirement accounts, part-time work, or spousal benefits.

According to the Bureau of Labor Statistics, labor force participation among Americans aged 65 to 74 has steadily increased over the past two decades. Analysts attribute this trend to longer life spans, improved health, and financial necessity.

Workers in physically demanding jobs may face more difficult trade-offs. Research from labor economists suggests that lower-income workers and those in manual occupations are less able to delay retirement, making early claiming more common despite reduced benefits.

“Retirement is no longer a single age or event,” a Brookings Institution retirement researcher said in a recent policy analysis. “It’s becoming a more gradual transition shaped by health, job flexibility, and financial resilience.”

Distributional and Equity Considerations

The retirement age changes coming in 2026 have uneven effects across income and demographic groups.

Higher-income workers tend to live longer, allowing them to collect benefits for more years and benefit more from delayed claiming. Lower-income workers, who often experience shorter life expectancy, may receive fewer lifetime benefits even if they contribute payroll taxes for decades.

Critics argue that raising the full retirement age effectively cuts benefits for those least able to adapt. Supporters counter that Social Security was never intended to serve as the sole source of retirement income.

These equity concerns continue to shape debates over future reforms, including proposals to increase benefits for low-income retirees or adjust benefit formulas based on lifetime earnings.

How the U.S. Compares Internationally

The retirement age changes coming in 2026 also place the United States closer to international norms.

Many developed countries have already raised retirement ages to 67 or higher in response to aging populations. Several European nations are indexing retirement age to life expectancy, allowing it to rise automatically over time.

In contrast, the U.S. system still relies on legislated changes rather than automatic adjustments, making reforms more politically sensitive and infrequent.

Broader Policy Debate Continues

While the current retirement age changes coming in 2026 complete an existing law, debate over Social Security’s future remains active in Washington.

Some policymakers have proposed further increases to the retirement age, while others favor raising or eliminating the payroll tax cap so higher earners contribute more. Still others advocate expanding benefits, particularly for caregivers and lower-income workers.

No legislation has been enacted to raise the full retirement age beyond 67. However, analysts say demographic trends and fiscal pressures ensure the issue will remain central to future policy discussions.

What Comes Next

For now, the retirement age changes coming in 2026 represent the final step of a reform passed more than 40 years ago. For millions approaching retirement, the shift underscores the importance of understanding benefit timing, income trade-offs, and long-term planning as traditional milestones continue to evolve.

FAQ

Does this mean I cannot retire at 65?

No. You can retire at 65, but you will not receive full Social Security benefits unless your full retirement age is 65, which applies only to older birth cohorts.

Will Social Security benefits be cut in 2026?

No benefits are being cut directly. The change affects when full benefits are available, not the benefit formula itself.

Does this affect Medicare eligibility?

No. Medicare eligibility remains at age 65.

Can I increase my benefit by delaying beyond 67?

Yes. Benefits increase through delayed retirement credits until age 70.