Claims of an IRS $1390 direct deposit circulating online in 2025 have sparked confusion among taxpayers, but federal officials say no new stimulus or universal payment program exists. Instead, experts say deposits near that amount usually reflect routine tax refunds or credit adjustments tied to individual filings, not a new government benefit.

Table of Contents

IRS $1390 Direct Deposit

| Key Fact | Detail |

|---|---|

| New $1390 stimulus? | No federal program approved for 2025 |

| Why people see $1,390 | Refunds, credits, amended returns |

| Scam risk | High, driven by social media |

| Congressional action | No legislation authorizing new payments |

| IRS contact rules | IRS does not initiate payment contact |

What Is Driving the IRS $1390 Direct Deposit Claims

Online posts and videos have repeatedly claimed that the federal government is issuing a new $1,390 payment in 2025. These assertions have appeared across Facebook, TikTok, YouTube, and smaller messaging platforms, often framed as “confirmed,” “just approved,” or “quietly released.”

The Internal Revenue Service has made no such announcement. In recent public guidance, the agency reaffirmed that all pandemic-era Economic Impact Payments ended years ago and that no new stimulus legislation has been enacted by Congress.

Tax officials say the claims often recycle old language from previous relief programs, changing only the dollar amount and the year. The repetition gives the impression of legitimacy, particularly to taxpayers already expecting refunds.

“There is no special payment amount being issued automatically in 2025,” the IRS has stated in response to similar claims in prior years. “Any payment issued by the IRS is based on a filed tax return or legally authorized credit.”

Why Some Taxpayers Are Receiving Deposits Around $1390

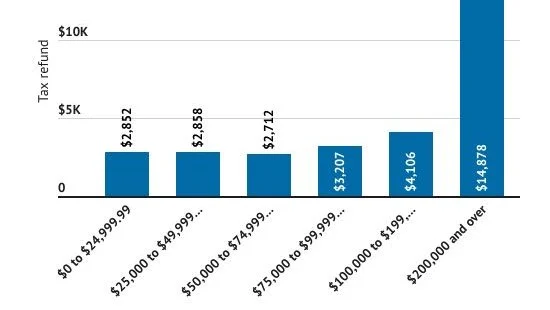

Tax professionals say confusion often arises because refund totals vary widely and can cluster around similar amounts. A refund near $1390 is neither unusual nor indicative of a special program.

According to analysts at the Urban-Brookings Tax Policy Center, deposits in this range commonly result from:

- Standard tax refunds, especially for single filers with moderate withholding

- Refundable credits, including the Earned Income Tax Credit (EITC)

- Amended returns or late adjustments from prior-year filings

- Interest added to delayed refunds, which the IRS is legally required to pay

“These are not stimulus checks,” said Howard Gleckman, a senior fellow at the center. “They are routine outcomes of the tax system working as designed, even if the timing makes them feel unexpected.”

Refund timing can also play a role. Taxpayers who file electronically and select direct deposit may receive funds weeks earlier than those who file by mail, increasing the visibility of deposits during peak rumor cycles.

Historical Context: Why Stimulus Rumors Persist

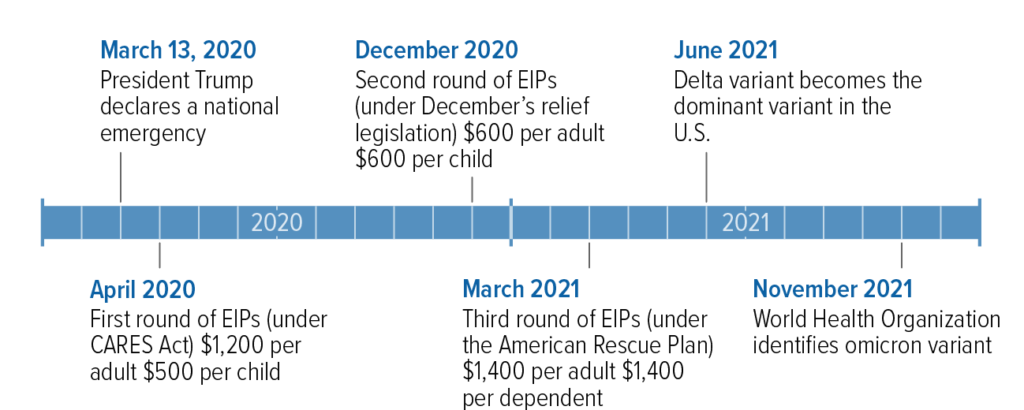

The persistence of stimulus-related rumors reflects the lasting imprint of pandemic-era relief programs. Between 2020 and 2021, Congress authorized three rounds of direct payments that reached most American households.

Those programs were highly visible, widely discussed, and often adjusted retroactively, creating confusion even years later. Many taxpayers continue to associate the IRS with surprise payments, despite the agency’s return to its traditional role.

Economists say the unusual scale of those programs reshaped public expectations. “People became accustomed to the idea that the government might send money during periods of stress,” said Maya MacGuineas, president of the Committee for a Responsible Federal Budget. “That expectation has outlasted the policy reality.”

No New Stimulus Authority in Congress

Any new nationwide payment would require congressional approval and a presidential signature. As of mid-2025, lawmakers have not passed legislation authorizing new direct payments tied to inflation, tariffs, or cost-of-living pressures.

Budget analysts note that current debates in Washington focus on deficit reduction, entitlement reform, and targeted tax incentives rather than broad cash relief. Several proposals aimed at middle- and low-income households have stalled amid disagreements over funding and scope.

“There is no hidden stimulus,” said a senior congressional aide familiar with tax negotiations. “If Congress were authorizing payments of this size, it would be a major public debate.”

The Role of Algorithms and Viral Misinformation

The spread of IRS payment rumors is amplified by social media algorithms that reward engagement over accuracy. Short videos promising money tend to perform well, even when unsupported by evidence.

Digital misinformation researchers say creators often reuse identical scripts year after year. Only the payment amount changes. The format remains the same: urgent language, vague sourcing, and calls to “check eligibility now.”

“These videos thrive on uncertainty,” said Nina Jankowicz, a misinformation researcher and former adviser to the U.S. government. “They exploit the complexity of the tax system and the public’s limited access to authoritative explanations.”

Rising Scam Activity Around IRS Direct Deposit Rumors

The Federal Trade Commission (FTC) reports a steady rise in scams exploiting false IRS payment claims. Fraudsters often impersonate government officials and request bank details, Social Security numbers, or small “processing fees.”

Victims may receive emails, text messages, or automated calls claiming that funds are “pending” and require confirmation. In reality, the IRS does not initiate contact in this way.

“Scammers follow the headlines,” said an FTC spokesperson. “Whenever there is economic anxiety, they adapt their messages to sound official and urgent.”

How Legitimate IRS Payments Are Issued

Legitimate IRS payments are tied directly to a filed tax return or a legally authorized adjustment. Direct deposit occurs only when taxpayers provide banking information during filing or through approved IRS tools.

Those without direct deposit on file receive paper checks or prepaid debit cards by mail. Processing times vary depending on filing method, verification requirements, and seasonal workload.

Tax experts emphasize that legitimate payments always appear in an official IRS account transcript, which taxpayers can access online.

What Taxpayers Should Do Now

Financial advisors recommend that taxpayers:

- Check refund status only through official IRS channels

- Review tax transcripts for accuracy and unexpected adjustments

- File early and electronically when possible

- Ignore unsolicited messages claiming special payments

Certified public accountant Melanie Lauritsen said, “If a payment is real, it will appear clearly in your IRS account. There are no shortcuts, and there is no registration process for surprise money.”

FAQ

Is the IRS issuing a $1390 stimulus check in 2025?

No. There is no authorized stimulus or universal payment program for 2025.

Why did I receive a deposit close to $1390?

It is likely a standard refund, a refundable tax credit, or a correction tied to your tax return.

Can the IRS text or email me about payments?

No. The IRS does not initiate contact through text messages, social media, or unsolicited emails.

Could future stimulus payments happen?

Only if Congress passes new legislation and the president signs it into law. No such bill currently exists.

What to Watch Going Forward

Tax policy analysts say confusion may intensify as the 2025 filing season progresses. Refunds, delayed credits, and amended returns will continue to generate deposits that appear sudden to taxpayers.

At the same time, economic uncertainty, rising prices, and election-year rhetoric may fuel renewed speculation about government relief. Officials urge taxpayers to separate political debate from enacted policy.

“The best defense is information,” said a former IRS commissioner. “When people understand how the system works, rumors lose their power.”

Final Note

Federal officials say misinformation about tax payments resurfaces each year, particularly during filing season. Taxpayers are urged to rely on official government sources and licensed professionals as the 2025 tax cycle continues, with no evidence of new direct-payment programs on the horizon.