Reports circulating online about a $2,000 IRS Direct Deposit December 2025 have drawn widespread attention, but U.S. tax authorities have issued no confirmation. While Americans continue receiving routine tax refunds and federal benefit payments, no new stimulus-style direct deposit has been authorized by Congress or announced by the Internal Revenue Service, according to official government records and statements.

Table of Contents

IRS Direct Deposit December 2025

| Key Fact | What We Know |

|---|---|

| $2,000 direct deposit confirmed? | No new payment authorized or announced |

| Why people see $2,000 deposits | Routine refunds, amended returns, tax credits |

| New stimulus legislation | None passed as of December 2025 |

| Risk to consumers | Scams and misinformation |

What Is Officially Confirmed by the IRS

No New $2,000 Federal Payment Has Been Approved

The Internal Revenue Service (IRS) has not announced any special $2,000 direct deposit scheduled for December 2025. A review of IRS press releases, Treasury Department statements, and congressional records shows no legislation authorizing a new stimulus or relief payment.

Under U.S. law, the IRS cannot independently issue payments of this kind. Any broad direct payment requires explicit congressional approval, funding authorization, and implementation guidance from the Department of the Treasury.

As of late December 2025, neither the House of Representatives nor the Senate has passed legislation directing the IRS to distribute a $2,000 payment.

An IRS spokesperson previously told major news organizations that “there are no new Economic Impact Payments planned or scheduled,” reaffirming that position amid renewed public speculation.

Regular Tax Refunds Are Still Being Issued

While no new stimulus exists, the IRS continues issuing routine tax refunds throughout the year, including in December. These refunds can exceed $2,000 and are often tied to:

- Late-filed individual tax returns

- Amended returns correcting prior filings

- Refundable credits such as the Earned Income Tax Credit (EITC) or Additional Child Tax Credit

- Adjustments resulting from IRS error corrections

According to IRS operational data, millions of refunds are issued outside the traditional spring tax season annually, particularly as amended returns are processed.

Why the $2,000 IRS Direct Deposit Rumor Spread

Confusion Between Refunds and Stimulus Payments

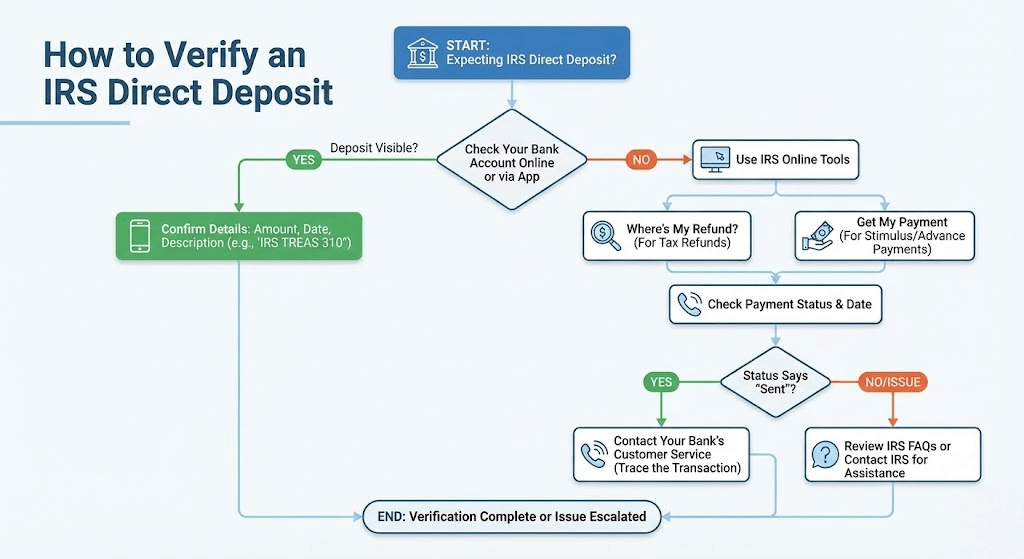

Tax experts say one of the main drivers of confusion is the way IRS deposits appear in bank accounts. Many are labeled with generic descriptions such as “IRS TREAS 310,” which does not specify the nature of the payment.

“These deposits often arrive without advance notice, especially for amended returns,” said Howard Gleckman, a senior fellow at the Urban-Brookings Tax Policy Center. “People understandably associate unexpected IRS deposits with stimulus checks, even when they are simply routine refunds.”

For taxpayers who had been eligible for pandemic-era stimulus payments, the memory of sudden deposits remains strong, making newer refunds easy to misinterpret.

Social Media Amplification and Algorithmic Incentives

The spread of claims about a $2,000 IRS Direct Deposit December 2025 has been accelerated by social media platforms and ad-driven websites. Analysts note that some outlets rely on vague headlines that imply confirmation while offering little verifiable sourcing.

Search algorithms and social media feeds tend to reward emotionally charged or financially enticing content, further amplifying unverified claims.

What Has Not Been Confirmed

No New Stimulus Legislation

Although some policymakers have discussed ideas such as tariff rebates, inflation relief payments, or middle-class tax offsets, none of these proposals have advanced into enacted law.

Policy analysts emphasize a key distinction: proposals, campaign statements, and opinion pieces do not translate into IRS action.

The last federal stimulus payments were authorized during the COVID-19 pandemic through legislation passed between 2020 and 2021. Those programs have formally concluded.

No Payment Schedule or Eligibility Criteria

Historically, when stimulus payments are approved, the IRS releases detailed guidance outlining eligibility thresholds, income limits, and payment timelines. No such guidance exists for December 2025.

The absence of these materials is a strong indicator that no new payment program is underway.

How IRS Payments Normally Work

The Legal and Administrative Process

To issue a nationwide payment, the federal government must follow a multi-step process:

- Congress passes legislation authorizing funds

- The Treasury allocates funding and instructs the IRS

- The IRS publishes guidance and timelines

- Payment infrastructure is activated

None of these steps have occurred in relation to a December 2025 $2,000 payment.

Why Refund Timing Varies

Refund timing depends on several factors, including filing method, verification checks, and whether credits are claimed. Amended returns, in particular, can take months to process, resulting in deposits long after the original filing season.

How to Identify Legitimate IRS Payments

The IRS urges taxpayers to rely only on official tools and communications. Legitimate IRS payments will correspond to:

- A filed or amended tax return

- An IRS notice mailed to the taxpayer’s address of record

- Refund tracking information available through IRS.gov

The agency repeatedly warns that it does not initiate contact by email, text message, or social media to request personal or banking information.

Consumer Risks and Scam Warnings

Periods of financial uncertainty often coincide with an increase in fraud attempts. Scammers may use headlines about a $2,000 IRS Direct Deposit December 2025 to impersonate government officials or lure victims into sharing sensitive data.

The IRS advises consumers to report suspicious messages and to delete unsolicited communications claiming to offer expedited payments or special eligibility.

Broader Context: Why New Stimulus Is Unlikely

Economists note that current federal fiscal policy is focused more on managing long-term deficits and interest costs than on issuing broad-based cash payments.

“Stimulus payments tend to emerge during acute economic crises,” said Sarah Binder, a political scientist at George Washington University. “Absent a recession or systemic shock, there is limited appetite for large, universal payments.”

Recent economic data showing moderate growth and easing inflation has further reduced momentum for emergency fiscal measures.

What Happens Next

Unless Congress passes new legislation, no additional IRS direct payments will be issued beyond routine refunds and existing benefit programs. Taxpayers expecting money from the IRS should monitor their refund status using official tools and remain cautious about unverified claims circulating online.

Any future stimulus or rebate program would almost certainly be announced publicly and covered extensively by major news organizations before payments began.

FAQ

Is there a confirmed $2,000 IRS Direct Deposit in December 2025?

No. The IRS has not confirmed or announced such a payment.

Why did I receive an IRS deposit close to $2,000?

It is most likely a routine tax refund, amended return adjustment, or refundable credit.

Will there be another stimulus check in 2026?

There is no enacted legislation authorizing future stimulus payments at this time.

How can I protect myself from IRS-related scams?

Only use IRS.gov and official correspondence, and ignore unsolicited messages claiming immediate payment.